Michigan Sales Tax Calculator

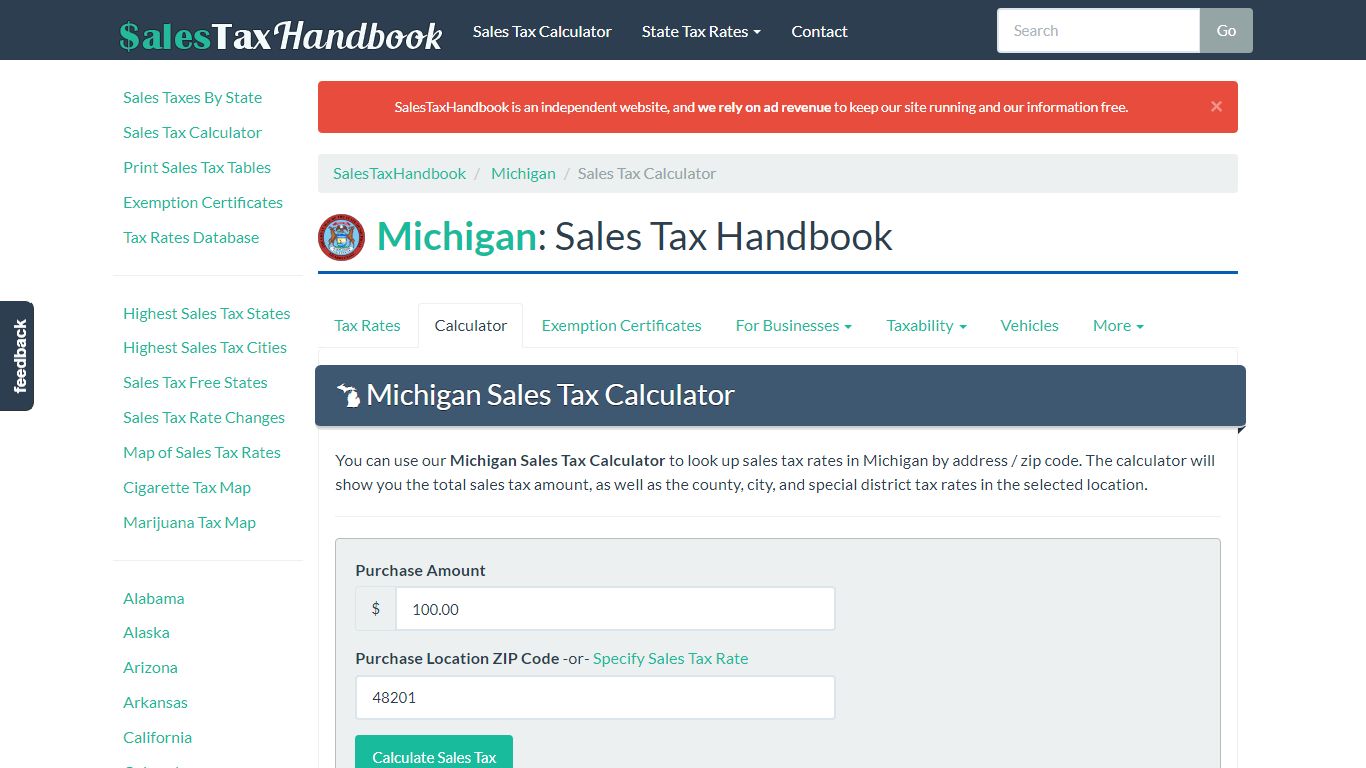

Michigan Sales Tax Calculator - SalesTaxHandbook

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Amount Purchase Location ZIP Code -or- Specify Sales Tax Rate Michigan has a 6% statewide sales tax rate , and does not allow local governments to collect sales taxes.

https://www.salestaxhandbook.com/michigan/calculator

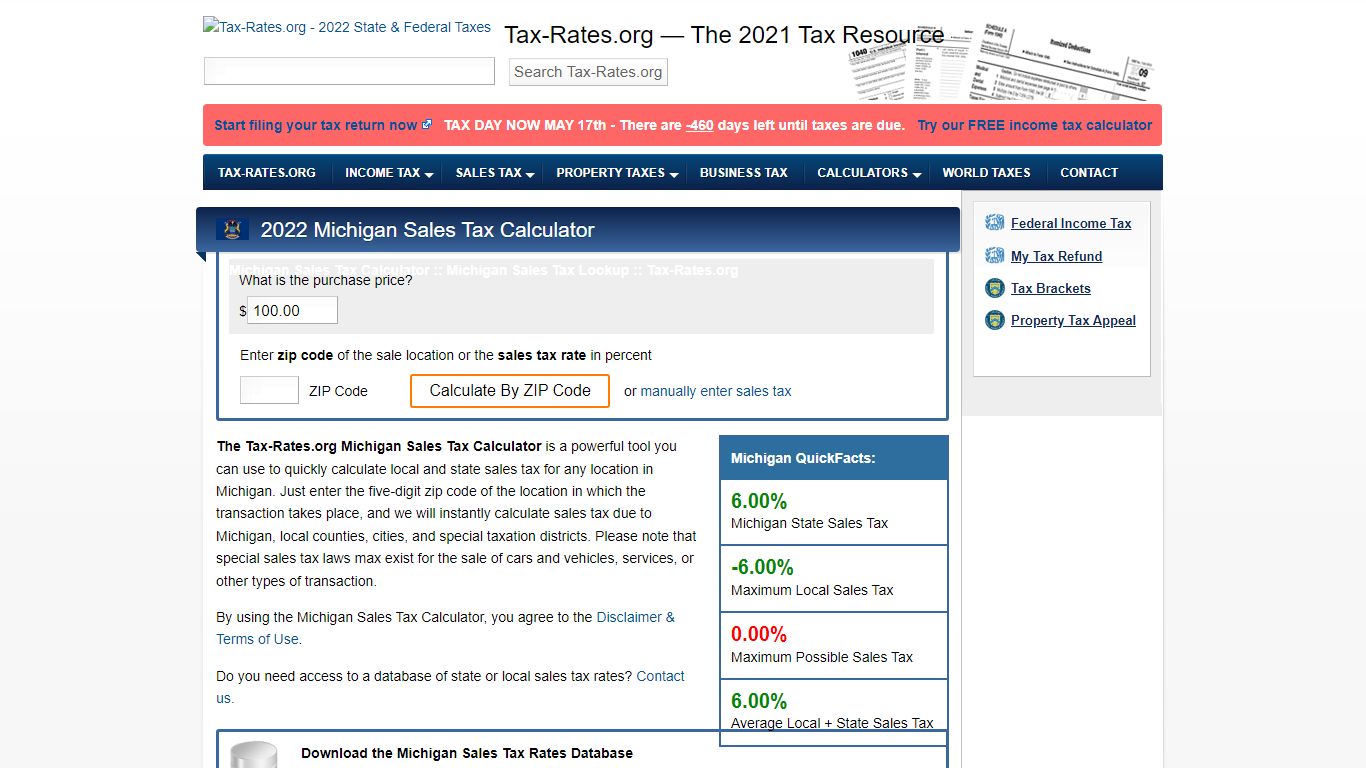

Michigan Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Michigan, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/michigan/sales-tax-calculator

Michigan Sales Tax Calculator

Enter zip codeof the sale location or the sales tax ratein percent % Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Michigan QuickFacts: 6.00% Michigan State Sales Tax -6.00% Maximum Local Sales Tax 0.00% Maximum Possible Sales Tax 6.00% Average Local + State Sales Tax

https://www.tax-rates.org/michigan_/sales-tax-calculator

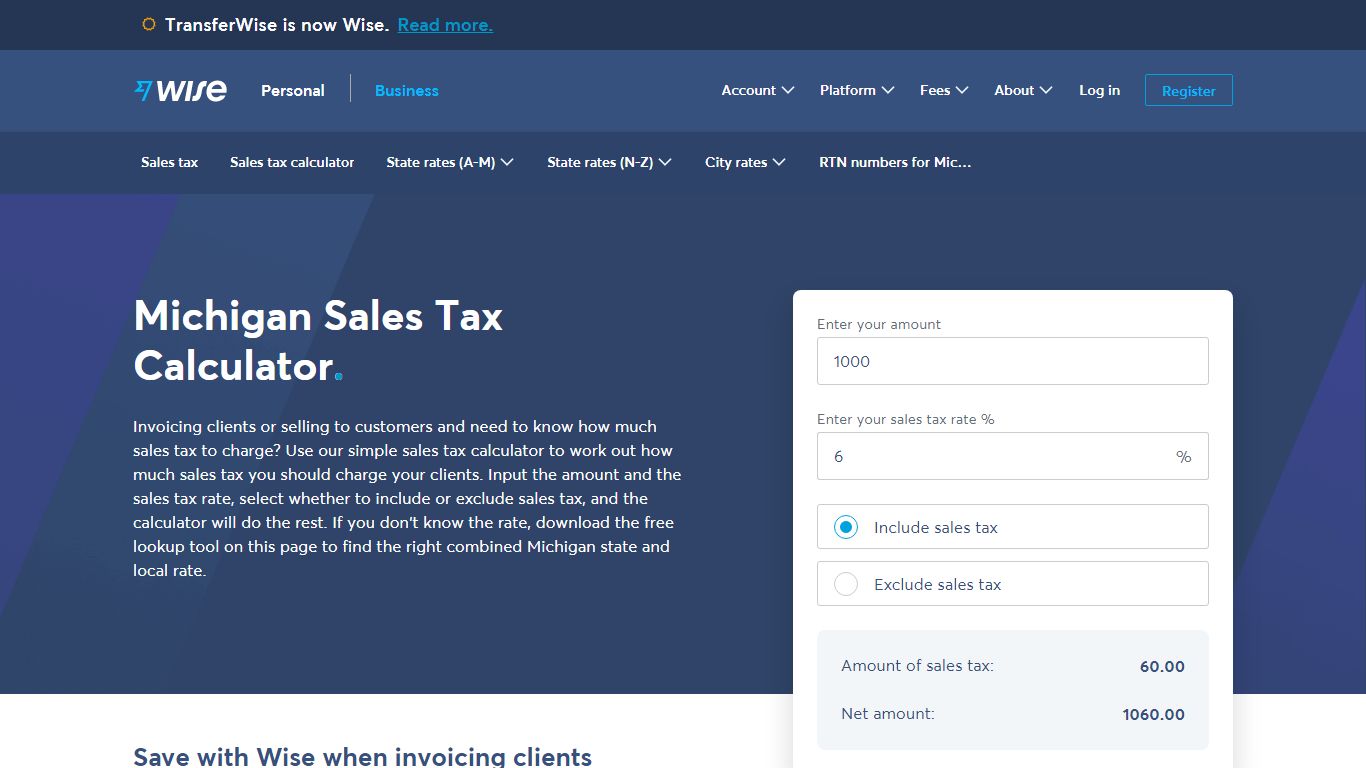

Michigan Sales Tax | Calculator and Local Rates | 2021 - Wise

The base state sales tax rate in Michigan is 6%. Local tax rates in Michigan range from 6.00%, making the sales tax range in Michigan 6.00%. Find your Michigan combined state and local tax rate. Michigan sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

https://wise.com/us/business/sales-tax/michigan

Michigan Sales Tax calculator, US

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Sales and Gross Receipts Taxes in Michigan amounts to 13.4 billion. It is 47.78 % of the total taxes (28.1 billion) raised in Michigan. Numbers represent only state taxes, not federal taxes. Breakdown of taxes in Michigan (excl. federal taxes)

https://vat-calculator.net/us-sales-tax/michigan

Michigan Sales Tax Calculator and Economy - Investomatica

Sales Tax Table For Michigan. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 6% in Michigan. All numbers are rounded in the normal fashion. To calculate the sales tax amount for all other values, use our sales tax calculator above.

https://investomatica.com/sales-tax/united-states/michigan

Sales and Use Tax - Michigan

Streamlined Sales and Use Tax Project. Notice of New Sales Tax Requirements for Out-of-State Sellers. For transactions occurring on and after October 1, 2015, an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act (MCL 205.52b) and Use Tax Act ...

https://www.michigan.gov/taxes/business-taxes/sales-use-tax

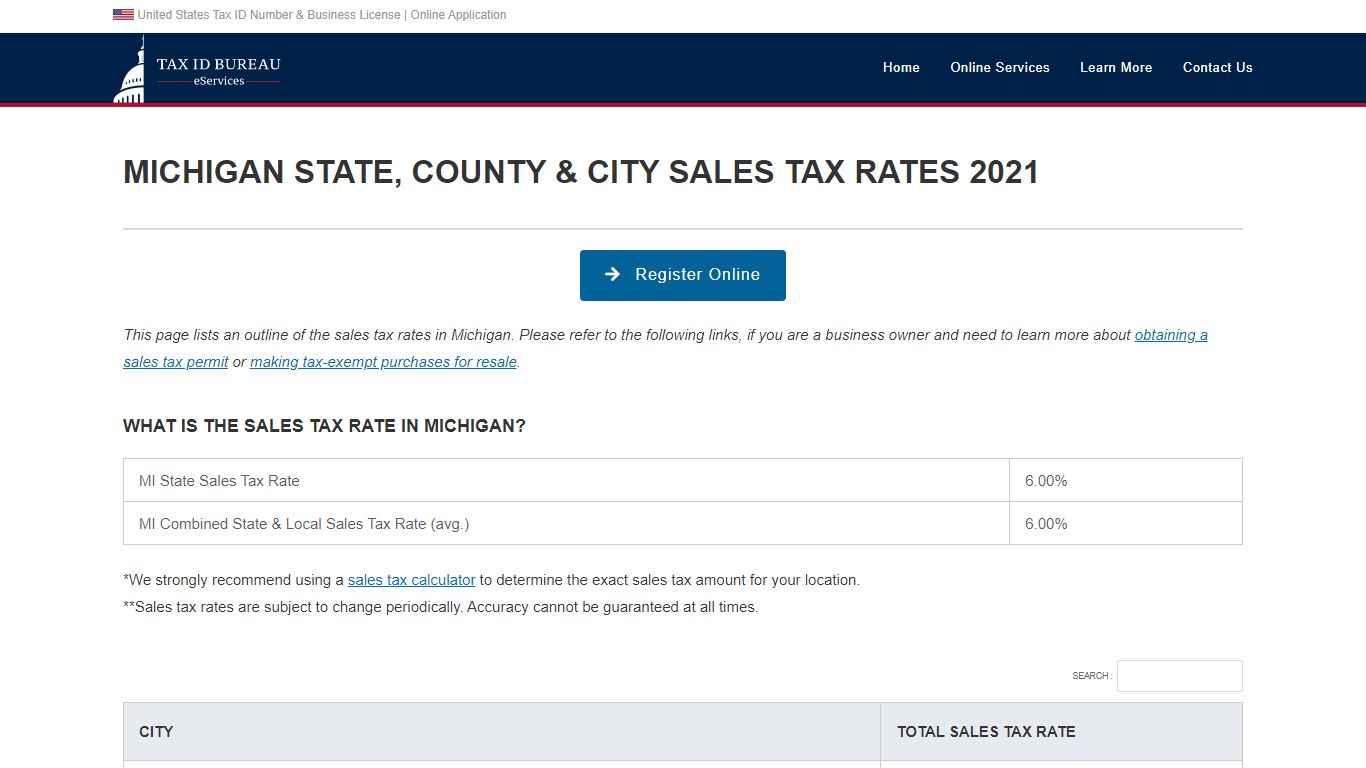

Michigan Sales Tax Calculator | MI Rates by County and City

Look up 2021 Michigan sales tax rates in an easy to navigate table listed by county and city. Free sales tax calculator tool to estimate total amounts.

https://www.tax-id-bureau.com/michigan-sales-tax-rates/

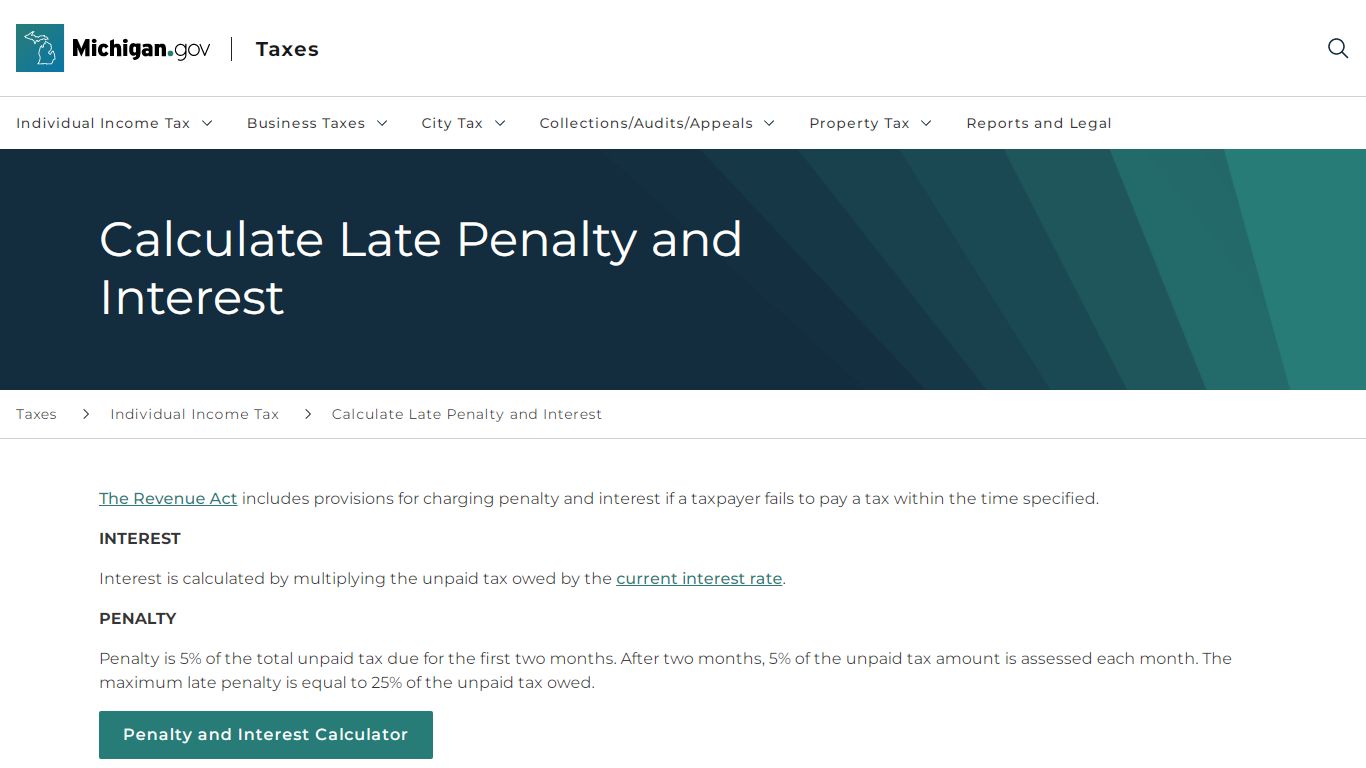

Calculate Late Penalty and Interest - Michigan

Interest is calculated by multiplying the unpaid tax owed by the current interest rate. PENALTY . Penalty is 5% of the total unpaid tax due for the first two months. After two months, 5% of the unpaid tax amount is assessed each month. The maximum late penalty is equal to 25% of the unpaid tax owed. Penalty and Interest Calculator

https://www.michigan.gov/taxes/iit/tools/calculate-late-penalty-and-interest

Property Tax Estimator - Michigan

Sales and Use Tax Sales and Use Tax ... Property Tax Estimator Notice. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance . If you attempt to use the link below and are unsuccessful, please try again at a later time. ...

https://www.michigan.gov/taxes/property/estimator